Introduction: Why this Matters to Your 401(k) Plan

As a 401(k) plan administrator, you aren't just managing payroll and paperwork — you're a fiduciary. This role demands trust, diligence, and the highest ethical standards. Under ERISA (Employee Retirement Income Security Act of 1974), fiduciaries must act in the best interests of participants, manage investments prudently, and avoid conflicts of interest Steptoe & Johnson PLLC+14DOL+14T. Rowe Price+14.

Failing in these duties can lead to personal liability, Department of Labor (DOL) investigations, or even participant lawsuits EN+4Finance Strategists+4Employee Fiduciary+4. But with clarity and smart planning, you can meet your duties confidently and professionally.

1. Defining Fiduciary Duty

A fiduciary:

-

Acts solely for plan participants’ benefit

-

Exhibits care, skill, prudence, and diligence

-

Follows plan documents

-

Diversifies investments

-

Avoids conflicts of interest Employee Fiduciary+3Employee Fiduciary+3EN+3Evensky+11IRS+11worldadvisors.com+11

These duties are function‑based, meaning anyone exercising control over plan assets or administration becomes a fiduciary — regardless of their title Copper Leaf Financial+14IRS+14Conrad Siegel+14.

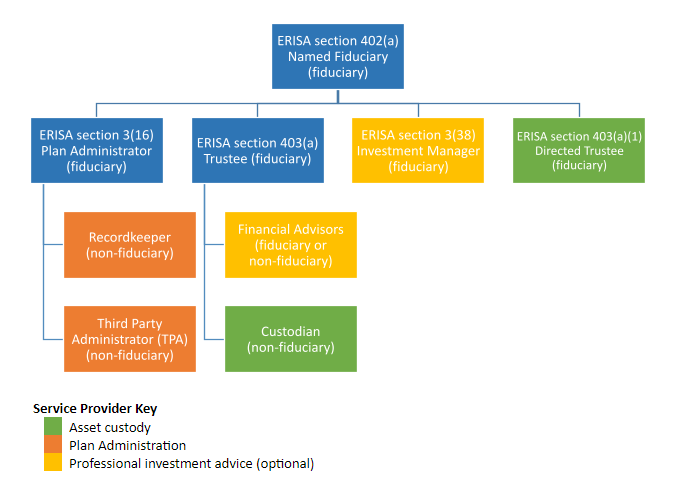

2. Who Are Your Co‑Fiduciaries?

While you may hold the title, others often share fiduciary responsibility:

-

Plan Sponsor: Usually the employer, sets the plan design but may also wear the fiduciary hat Conrad SiegelConrad Siegel+11Human Interest+11Newfront+11

-

Named Fiduciary (ERISA 402(a)): Explicitly designated in plan docs SHRM+7Newfront+7Employee Fiduciary+7

-

Plan Administrator (ERISA 3(16)): Manages daily operations Copper Leaf Financial+15Newfront+15Human Interest+15

-

Investment Advisor (ERISA 3(21)): Offers advice for fees; co‑fiduciary Conrad Siegel+5Newfront+5Evensky+5

-

Investment Manager (ERISA 3(38)): May be delegated full authority to choose investments Evensky+1Finance Strategists+1

-

Trustees: Hold plan assets; may operate independently or be the sponsor Evensky+14Human Interest+14DOL+14

Key takeaway: Delegation doesn't remove liability. Even with third‑party help, you're still responsible for overseeing their work .

3. Core Fiduciary Obligations & Practical Tips

3.1 Investment Management

-

Select prudent, diversified funds

-

Opt for index funds (Vanguard, Fidelity, BlackRock, Schwab) with low fees The Sun+2Employee Fiduciary+2Finance Strategists+2.

-

Maintain a diverse lineup across asset classes (equities, bonds, cash) SHRM+2Investopedia+2The Sun+2.

-

-

Create & follow an Investment Policy Statement (IPS)

-

Documents objectives, roles, decision process Copper Leaf Financial+2planperfectretirement.com+2Newfront+2.

-

Helps avoid ad‑hoc decisions and audits scrutiny Employee Fiduciary.

-

-

Monitor investments regularly

-

Annual review (min.) — ideally quarterly Copper Leaf Financial+6Evensky+6Employee Fiduciary+6.

-

Compare performance, check fee benchmarks and document findings Finance Strategists.

-

3.2 Administrative Responsibilities

• Timely Deposits

-

Small plans (≤100 participants): deposit deferrals within 7 days

-

Large plans: by 15th business day of next month Investopedia+12SHRM+12Conrad Siegel+12Finance Strategists+1IRS+1

• Compliance Oversight

-

Perform nondiscrimination tests

-

Manage loans, rollovers, distributions, QDROs

-

Track eligibility, enrollment, terminations IRS+15Anders+15planperfectretirement.com+15Finance StrategistsForUsAll+1Newfront+1

• Reporting & Disclosure

-

Provide Summary Plan Description (SPD), Summary Annual Report (SAR) annually

-

File Form 5500, Form 8955‑SSA and Safe Harbor notices Steptoe & Johnson PLLC+9Anders+9Newfront+9

• Fiduciary Bond

-

Secure ERISA bond: covers ≥10% of plan assets (max $500K) Finance Strategists

• Provider Oversight

-

Select transparent, competent providers

-

Benchmark fees every 2–3 years

-

Document decision-making process Finance Strategists+2Finance Strategists+2planperfectretirement.com+2

3.3 Fee Management

-

Ensure reasonableness of all plan fees

-

Compare to national benchmarks (0.5–2%) Finance Strategists+2Investopedia+2Newfront+2

-

Avoid hidden “junk fees” — DOL crackdown expected DOL+7Investopedia+7Finance Strategists+7

-

-

Transparent disclosure

-

Provide fee info to participants in understandable formats

-

4. Best Practices & Governance

✅ Form a Fiduciary Committee

-

Combines diverse expertise

-

Spread responsibilities to minimize risk Investopedia+10EN+10IRS+10

✅ Document Governance

-

Develop committee charters, IPS, service‑provider RFPs, meeting minutes Copper Leaf Financial+3EN+3planperfectretirement.com+3

✅ Training & Meetings

-

Schedule quarterly or semi‑annual meetings

-

Provide fiduciary education/training for members Evensky+14EN+14T. Rowe Price+14

✅ Review & Audit

-

Conduct annual compliance audits

-

Monitor providers, investments, administration

-

Maintain documentation of processes, actions, and follow‑ups

5. Legal Consequences of Breaching Fiduciary Duty

Failing these duties can have severe consequences:

-

DOL enforcement: fines, restitution orders, and removal from fiduciary role Admin316+4ForUsAll+4Newfront+4NewfrontNewfront+11DOL+11Finance Strategists+11

-

Lawsuits by participants: compensation or class-action litigation Finance Strategists+1Newfront+1

-

Personal liability: must restore any losses and gains from misuse DOL+1Finance Strategists+1

Real-world example:

Genentech’s recent class‑action suit alleged high record-keeping fees and poor fund selections — leading to a $250K settlement T. Rowe Price+1Employee Fiduciary+1.

Table: Quick Comparison of Fiduciary Roles

| Role | Designates Assets? | Daily Ops? | Investment Discretion? | Legal Duty Type |

|---|---|---|---|---|

| Plan Sponsor | ✔ (may) | ✔ | ✖ (business decisions) | Settlor / fiduciary |

| Named Fiduciary (402(a)) | ✔ | ✔ | ✖ | Fiduciary |

| Plan Administrator (3(16)) | ✔ | ✔ | ✖ | Fiduciary |

| Investment Advisor (3(21)) | ✖ | ✖ | Recommendations | Co‑fiduciary |

| Investment Manager (3(38)) | ✔ | ✖ | ✔ | Fiduciary with discretion |

| Trustee | ✔ | ✖ | ✖ (executes instructions) | Fiduciary |

6. Practical Tips: A Fiduciary To‑Do Checklist

-

Review plan documents: Confirm named fiduciary, committee structure, IPS, amendments DOL+15SHRM+15Human Interest+15Copper Leaf Financial+6Newfront+6ForUsAll+6

-

Benchmark investments/fees: At least annually, using comparable plan data Finance Strategists+1Finance Strategists+1

-

Ensure timely deposits: Log all participant contributions; adhere to 7/15‑day rules

-

Educate beneficiaries: Provide clear materials and Q&A sessions

-

Monitor service providers: Regular performance reviews against contract standards

-

Maintain records: Save provider reports, meeting minutes, board resolutions, audits

-

Train fiduciaries: Subscribe to fiduciary education annually, e.g., through DOL or industry groups worldadvisors.com+5DOL+5Evensky+5worldadvisors.com

Conclusion: Confidently Fulfilling Your Duty

Being a 401(k) plan administrator means upholding high standards of trust and diligence — for your participants and your organization. By embracing ERISA fiduciary duties, you can build a secure, compliant, and efficient retirement plan.

Stay proactive:

-

Establish strong governance,

-

Document all decisions,

-

Monitor regularly,

-

Educate stakeholders.

This not only protects participants but also reduces your legal exposure and builds lasting confidence in your retirement plan.

FAQs

Q1: What makes someone a fiduciary?

Discrete control over plan assets or administration triggers fiduciary status — regardless of title Investopedia+9Human Interest+9EN+9DOL+3Admin316+3Evensky+3Investopedia+5IRS+5worldadvisors.com+5.

Q2: How often should I benchmark fees and investments?

At least annually, though quarterly reviews are advisable for robust oversight .

Q3: What happens if participant contributions are delayed?

Delays can incur DOL penalties and interest obligations — timely deposits are essential .

Q4: Can I delegate investment choices?

Yes — via an ERISA 3(38) advisor. However, oversight of their performance remains a fiduciary duty Newfront+2Evensky+2Finance Strategists+2.

Q5: How to protect myself legally?

Use formal governance: document everything, obtain fidelity bonds, engage trained providers, and maintain education planperfectretirement.com+1Anders+1.